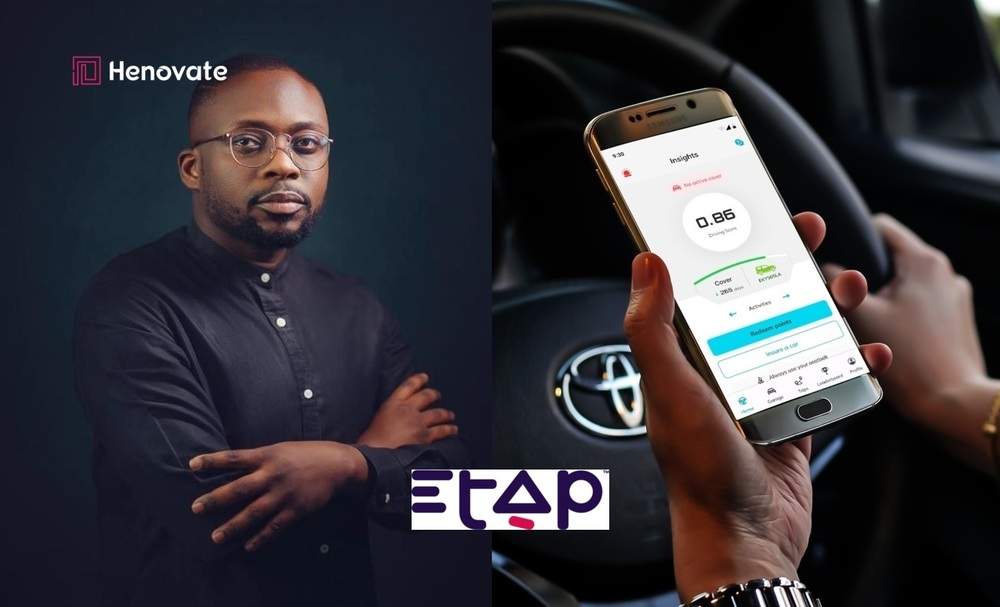

ETAP, a Nigerian-based insurtech startup, is revolutionizing car insurance in Africa by making it as “easy as taking a picture.”

The company, which stands for “Easy as Taking A Picture,” was founded on the principle that the car insurance process should be simple, fast, and enjoyable.

By utilizing advanced technology and innovative business models, ETAP is eliminating the common hassles associated with traditional car insurance processes. From offering flexible insurance plans to leveraging gamification to reward safe drivers, ETAP is setting new standards in the insurance industry and attracting both local and international attention.

Since its launch in 2022, ETAP has quickly gained traction across Nigeria and other parts of Africa. The startup’s mobile app allows drivers to get insurance coverage in under 90 seconds and file claims within three minutes.

This efficient system, combined with a unique rewards program, is making car insurance more accessible and engaging, particularly for first-time policyholders.

ETAP’s commitment to innovation has garnered it substantial funding, including a $1.5 million pre-seed round led by global investors like the Toyota Tsusho Corporation.

ETAP’s Approach to Simplifying Car Insurance

ETAP leverages advanced telematics and machine learning to create intelligent risk profiles for each driver, enabling personalized insurance pricing based on driving behavior.

This means safer drivers pay lower premiums, while those with higher risk behaviors are charged more, aligning insurance costs with actual risk levels.

This data-driven approach not only helps drivers save money but also encourages safer driving habits. The app tracks driving patterns such as speed, acceleration, and phone usage, providing users with a driving score after each trip.

Users can earn “Safe Driving Points” which can be redeemed for fuel, shopping vouchers, or entertainment tickets at popular outlets.

The gamification aspect of ETAP’s offering has been well-received. Drivers can compete for top spots on a leaderboard, with rewards tied to their driving performance. This system not only makes driving safer but also helps reduce insurance costs for good drivers, effectively turning insurance into an interactive and rewarding experience.

Flexible Insurance Plans and Partnerships:

To cater to diverse customer needs, ETAP offers a variety of insurance plans, including daily, weekly, monthly, and quarterly options. This flexibility is crucial in a market where traditional annual insurance premiums can be a significant financial burden.

Additionally, ETAP’s partnerships with key players like MTN and Suzuki have further extended its reach. For instance, MTN Nigeria users can access the ETAP platform without using data, making it more accessible for the millions of MTN subscribers across the country. Similarly, customers purchasing vehicles from Suzuki’s dealerships receive integrated insurance options through ETAP.

ETAP’s growth has also been driven by its strategic investor partnerships. Besides Toyota Tsusho Corporation, the startup is backed by other prominent investors, including Graph Ventures and Tangerine Insurance.

These partnerships not only provide capital but also help ETAP scale its technology and expand its services across new markets.

The company is in the final stages of approval to launch in Ghana and plans to enter Francophone Africa soon.

Overall, ETAP’s innovative approach to car insurance is helping to bridge the gap in a market that traditionally suffers from low insurance penetration, slow digitization, and a lack of flexible products.

As the company continues to grow, it aims to become a leading insurtech provider across Africa, transforming the way people perceive and interact with car insurance.